Delve into the world of real-time crypto indicators for smarter trading as we uncover the key strategies and tools that can elevate your trading game to new heights.

Explore the realm of real-time indicators and how they revolutionize the way traders make decisions in the fast-paced crypto market.

Real-Time Crypto Indicators Overview

Real-time crypto indicators play a crucial role in the world of trading by providing traders with up-to-the-second data and insights to make informed decisions. These indicators help traders identify trends, patterns, and potential entry or exit points in the volatile cryptocurrency market.Some popular real-time crypto indicators used by traders include:

Relative Strength Index (RSI)

This indicator measures the speed and change of price movements, indicating whether a cryptocurrency is overbought or oversold.

Moving Averages

Traders use moving averages to identify the direction of a trend and potential support or resistance levels.

Bollinger Bands

These bands help traders visualize volatility and potential price breakouts.Real-time indicators differ from traditional trading indicators in their immediacy and responsiveness to market movements. Traditional indicators may lag behind market changes due to delayed data, whereas real-time indicators provide instant updates, allowing traders to adapt quickly to changing market conditions.

Types of Real-Time Crypto Indicators

When it comes to real-time crypto trading, there are various types of indicators that traders use to make informed decisions. These indicators help traders analyze the market trends and predict potential price movements.

Technical Indicators

Technical indicators are mathematical calculations based on historical price, volume, or open interest data. These indicators help traders identify trends, momentum, volatility, and other important market characteristics. Some common technical indicators used in real-time crypto trading include:

- Moving Averages

- Relative Strength Index (RSI)

- Bollinger Bands

- MACD (Moving Average Convergence Divergence)

Fundamental Indicators

Fundamental indicators focus on the underlying factors that drive the value of a cryptocurrency. These indicators include factors such as project developments, partnerships, regulatory news, and market sentiment. Fundamental analysis is crucial for understanding the long-term prospects of a cryptocurrency and can complement technical analysis for real-time trading.

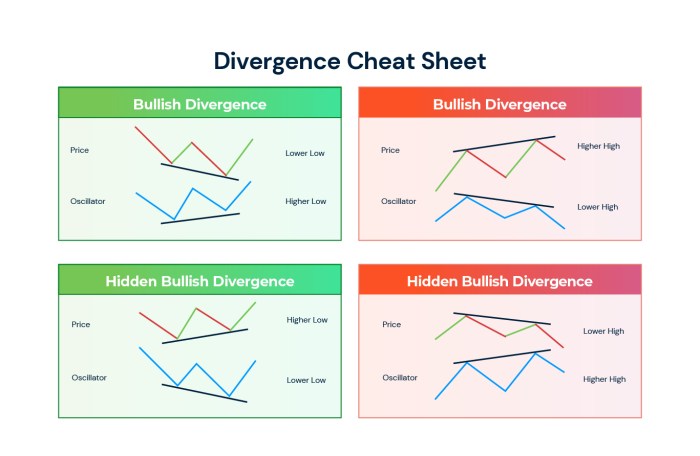

Leading vs. Lagging Indicators

Leading indicators provide signals before a trend or reversal occurs, helping traders anticipate potential price movements. On the other hand, lagging indicators follow price movements and confirm trends that have already begun. In real-time trading, leading indicators are more preferred as they provide early signals, allowing traders to enter or exit positions before the trend fully develops.

Strategies for Utilizing Real-Time Crypto Indicators

When it comes to trading cryptocurrencies, utilizing real-time indicators can significantly enhance your decision-making process. By combining multiple indicators and incorporating sentiment analysis, traders can gain a comprehensive understanding of market trends and make informed trading choices.

Combining Multiple Real-Time Indicators

Combining various real-time indicators can provide a more holistic view of the market, helping traders identify potential entry and exit points. Some common indicators to consider include moving averages, RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), and Bollinger Bands.

By analyzing these indicators collectively, traders can confirm signals and make more confident trading decisions.

Hypothetical Scenario: Utilizing Real-Time Indicators

Imagine a trader who is monitoring the price of Bitcoin using real-time indicators like MACD and RSI. The MACD indicator shows a bullish crossover, indicating a potential uptrend, while the RSI is approaching overbought territory. In this scenario, the trader may consider waiting for a pullback before entering a long position, leveraging the insights provided by both indicators.

Sentiment Analysis in Trading

Sentiment analysis involves assessing market sentiment, such as news, social media, and other factors that can impact asset prices. By combining sentiment analysis with real-time indicators, traders can gain a more nuanced view of the market. For example, if a positive news article about a specific cryptocurrency coincides with bullish signals from technical indicators, it may strengthen the trader's confidence in a long position.

Implementing Real-Time Crypto Indicators

When it comes to implementing real-time crypto indicators on a trading platform, there are a few key steps to follow to ensure you are utilizing them effectively.

Setting Up Real-Time Indicator Tools

Setting up real-time indicator tools involves choosing a reputable trading platform that offers a wide range of indicators to choose from. Once you have selected a platform, you can typically add indicators to your charts by navigating to the indicator menu and selecting the ones you want to use.

Customizing Indicator Settings

- Adjust the timeframes: Depending on your trading style, you may want to customize the timeframe of the indicators to suit your preferences. Short-term traders may opt for shorter timeframes, while long-term investors may prefer longer ones.

- Modify parameters: Some indicators allow you to adjust parameters such as sensitivity levels or moving averages. Experiment with these settings to find the configuration that works best for your trading strategy.

- Combine indicators: To get a more comprehensive view of the market, consider combining multiple indicators on your charts. This can help you confirm signals and make more informed trading decisions.

Automation and Alerts

Utilizing automation and alerts can greatly enhance the effectiveness of real-time crypto indicators. By setting up alerts for specific indicator signals, you can be notified in real-time when trading opportunities arise. Additionally, automation tools can help execute trades based on pre-set conditions, saving you time and ensuring you don't miss out on profitable opportunities.

Final Summary

In conclusion, mastering the art of utilizing real-time crypto indicators can be the game-changer you need to stay ahead in the ever-evolving world of cryptocurrency trading. Start implementing these techniques today and watch your trading prowess soar.

FAQ Explained

How do real-time crypto indicators impact trading decisions?

Real-time crypto indicators provide up-to-the-minute data on market trends, allowing traders to make informed decisions quickly.

What are some popular real-time indicators used by traders?

Common real-time crypto indicators include Moving Averages, Relative Strength Index (RSI), and Bollinger Bands.

How can sentiment analysis complement real-time indicators in trading?

Sentiment analysis helps traders gauge market sentiment and combine it with real-time indicators for a more comprehensive trading strategy.