As freelancers and contractors navigate the world of self-employment, understanding the crucial aspect of insurance requirements becomes paramount. This guide delves into the various types of insurance needed, highlighting the significance and benefits that come with being adequately covered.

Understanding Insurance Requirements

Insurance requirements for freelancers and contractors refer to the types of insurance coverage that individuals in these professions need to protect themselves, their businesses, and their clients from potential risks and liabilities.Freelancers and contractors typically require several types of insurance to safeguard their interests and ensure financial protection in case of unforeseen circumstances.

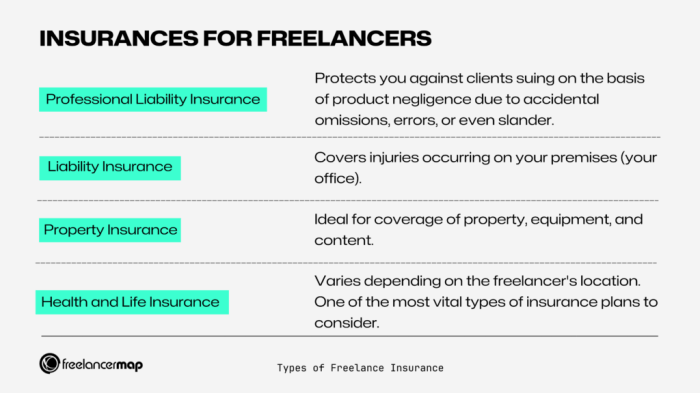

Some common types of insurance needed for freelancers and contractors include:

General Liability Insurance

General liability insurance provides coverage for third-party bodily injury, property damage, and advertising injury claims. It protects freelancers and contractors from lawsuits and financial losses resulting from accidents or negligence.

Professional Liability Insurance

Professional liability insurance, also known as errors and omissions insurance, protects freelancers and contractors from claims of professional negligence, errors, or omissions that result in financial harm to clients. It is essential for those providing professional services or advice.

Workers’ Compensation Insurance

Workers' compensation insurance is necessary for freelancers and contractors who have employees. It covers medical expenses and lost wages for employees who are injured or become ill while performing work-related duties.

Why Insurance is Essential

Insurance is essential for freelancers and contractors because it provides financial protection and peace of mind. It helps mitigate risks, safeguard assets, and ensure continuity of business operations in the face of unexpected events. Without adequate insurance coverage, freelancers and contractors may face significant financial losses and legal liabilities that could jeopardize their livelihoods and reputations.

Liability Insurance

Liability insurance is a type of coverage that protects freelancers and contractors from financial losses resulting from claims made against them for injury or property damage caused to others. It is crucial for freelancers and contractors as it provides a safety net in case of unexpected accidents or mishaps.

Types of Liability Insurance

- General Liability Insurance: This type of insurance covers bodily injury, property damage, and personal injury claims that may arise during work.

- Professional Liability Insurance: Also known as Errors and Omissions insurance, it protects against claims of negligence, errors, or omissions in the services provided.

- Product Liability Insurance: This coverage is essential for freelancers or contractors who sell or manufacture products, protecting them from claims related to product defects.

Situations where Liability Insurance is Important

- Accidental injury to a client or third party during a work project.

- Damages to a client's property while working on-site.

- A client suing for errors or negligence in the services provided.

Health Insurance

Health insurance is a crucial component for freelancers and contractors, as it provides coverage for medical expenses and helps protect against unexpected health issues. Having health insurance can offer peace of mind and financial security, ensuring that individuals can access necessary healthcare without worrying about the high costs associated with medical treatments.

Options for Obtaining Health Insurance

- Individual Health Plans: Freelancers and contractors can purchase individual health insurance plans directly from insurance providers or through the Health Insurance Marketplace.

- Spouse's Health Insurance: Some freelancers may be eligible to be covered under a spouse's employer-sponsored health insurance plan.

- Professional Associations: Freelancers and contractors may have access to group health insurance plans through professional associations or organizations.

- Healthcare Sharing Ministries: Some individuals opt for healthcare sharing ministries as an alternative to traditional health insurance.

Benefits of Health Insurance Coverage

- Financial Protection: Health insurance helps protect freelancers and contractors from high medical costs, reducing the risk of financial strain due to unexpected healthcare expenses.

- Access to Healthcare: With health insurance coverage, individuals can access a network of healthcare providers, receive necessary medical treatments, and prioritize their health and well-being.

- Preventive Care: Health insurance often covers preventive services such as annual check-ups, screenings, and vaccinations, promoting early detection and overall wellness.

Disability Insurance

Disability insurance is a type of coverage that provides financial protection in the event that you become unable to work due to a disability or illness. For freelancers and contractors, who do not have the safety net of traditional employee benefits, disability insurance can be crucial in ensuring financial stability during periods of inability to work.

Acquiring Disability Insurance

- Research different insurance providers that offer disability insurance for freelancers and contractors.

- Compare the coverage options, premiums, and terms of each insurance policy to find the best fit for your needs.

- Fill out an application for disability insurance and provide any necessary medical information or documentation required by the insurance provider.

- Once approved, make sure to understand the terms of the policy, including waiting periods, benefit amounts, and duration of coverage.

Advantages of Having Disability Insurance

- Income Protection: Disability insurance provides a source of income if you are unable to work due to a disability, ensuring that you can still meet your financial obligations.

- Peace of Mind: Knowing that you have financial protection in place in case of a disability can give you peace of mind and reduce stress during challenging times.

- Independence: With disability insurance, you can maintain your financial independence and avoid relying on savings or assistance from others to cover expenses.

- Professional Reputation: Having disability insurance can also enhance your professional reputation, showing clients and partners that you are prepared for unexpected circumstances.

Workers’ Compensation Insurance

Workers' compensation insurance is a crucial aspect for freelancers and contractors as it provides coverage for work-related injuries or illnesses. This type of insurance helps in ensuring that employees receive benefits for medical expenses and lost wages resulting from such incidents.

How Workers’ Compensation Insurance Works

- Scenario 1: A freelance graphic designer trips over a wire while setting up for a client meeting and injures their wrist. Workers' compensation insurance would cover their medical expenses and a portion of their lost income while they recover.

- Scenario 2: A contractor working on a construction site falls from a ladder and sustains a serious back injury. Workers' compensation insurance would help cover their hospital bills, rehabilitation costs, and ongoing treatment.

- Scenario 3: A freelance writer develops carpal tunnel syndrome from excessive typing. Workers' compensation insurance would assist in covering their medical treatments and any necessary time off work for recovery.

Legal Requirements for Workers’ Compensation Insurance

It is essential for freelancers and contractors to comply with state laws regarding workers' compensation insurance. In many states, even independent contractors are required to carry this type of insurance if they have employees working under them.

Property Insurance

Property insurance is essential for freelancers and contractors as it provides protection for their business equipment, tools, and physical workspace. In the event of theft, damage, or loss, property insurance can help cover the costs of repair or replacement, ensuring that the business can continue to operate smoothly.

Types of Property Insurance

- Business Property Insurance: Covers physical assets such as office space, equipment, and inventory.

- Business Interruption Insurance: Provides coverage for lost income and expenses if the business is unable to operate due to a covered loss.

- Equipment Breakdown Insurance: Protects against the cost of repairing or replacing essential business equipment.

Scenarios for Safeguarding Freelancers and Contractors

- Scenario 1: A freelancer's laptop is stolen from their home office. Property insurance can help cover the cost of a new laptop, ensuring that work can continue without major disruptions.

- Scenario 2: A contractor's tools are damaged in a fire at a job site. Property insurance can help cover the cost of repairs or replacements, allowing the contractor to fulfill their contractual obligations.

- Scenario 3: A freelancer's office space is flooded, damaging their equipment and furniture. Property insurance can help cover the cost of cleanup and replacements, minimizing the financial impact on the freelancer's business.

Closing Summary

From liability to health insurance, and workers' compensation to property insurance, the importance of safeguarding oneself as a freelancer or contractor cannot be overstated. By having a clear understanding of insurance requirements, individuals in this sector can protect themselves and their livelihood effectively.

Key Questions Answered

Is liability insurance necessary for freelancers and contractors?

Yes, liability insurance is crucial as it protects individuals in case of lawsuits or claims for damages arising from their work.

How can freelancers and contractors acquire health insurance?

Freelancers and contractors can obtain health insurance through private providers, healthcare exchanges, or professional associations.

What does disability insurance offer to freelancers and contractors?

Disability insurance provides financial protection in case an individual is unable to work due to a disability or illness.

Do freelancers and contractors need workers' compensation insurance?

While not mandatory for all, having workers' compensation insurance can provide crucial protection in case of work-related injuries or illnesses.

How does property insurance benefit freelancers and contractors?

Property insurance safeguards freelancers and contractors against losses or damages to their equipment, workspace, or other business-related property.