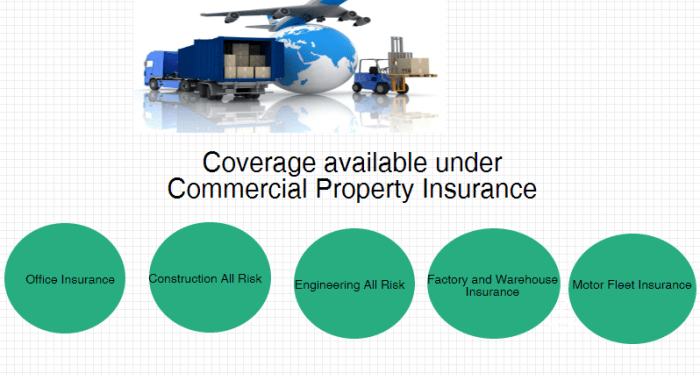

Commercial Property Insurance: What It Covers and Why sets the stage for this informative discussion, providing a comprehensive look at the coverage and significance of commercial property insurance.

Exploring the various aspects of commercial property insurance, this topic delves into the specifics of coverage, exclusions, factors affecting premiums, and key considerations when choosing a policy.

Introduction to Commercial Property Insurance

Commercial property insurance is a type of insurance policy that provides coverage for physical assets and properties owned by a business. This insurance helps protect businesses from financial losses due to damage or destruction of their properties.

Importance of Commercial Property Insurance

Having commercial property insurance is crucial for businesses to safeguard their physical assets from various risks and uncertainties. In the event of unexpected events such as natural disasters, fires, theft, or vandalism, this insurance can provide financial support to repair or replace damaged properties, ensuring business continuity.

Types of Properties Covered

- Buildings: Commercial property insurance covers the physical structure of buildings owned by the business, including offices, warehouses, and retail spaces.

- Equipment and Inventory: This insurance also extends coverage to equipment, machinery, and inventory stored within the premises.

- Furniture and Fixtures: Furniture, fixtures, and other assets essential for business operations are typically included in the coverage.

- Outdoor Signs: Commercial property insurance may also cover outdoor signage used for business advertising.

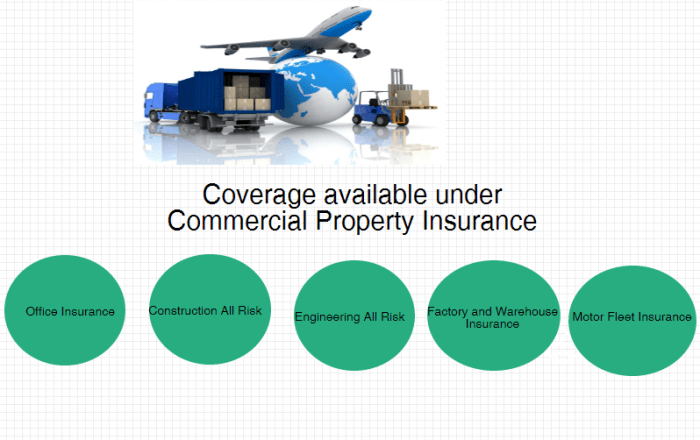

Coverage Offered by Commercial Property Insurance

Commercial property insurance provides coverage for a wide range of risks that businesses face. This type of insurance is essential for protecting your company's physical assets and ensuring business continuity in case of unexpected events.

Specific Risks Covered by Commercial Property Insurance

- Fire damage: Commercial property insurance typically covers damage caused by fires, including structural damage and loss of inventory or equipment.

- Water damage: This includes damage from burst pipes, leaks, or flooding, which can cause significant harm to your property.

- Natural disasters: Coverage may extend to damage caused by events like hurricanes, earthquakes, or tornadoes.

- Theft and vandalism: Insurance can help cover the costs of replacing stolen goods or repairing damage caused by vandalism.

Examples of Incidents Covered by Commercial Property Insurance

- If a fire breaks out in your office building and causes damage to the structure and furniture, commercial property insurance can help cover the costs of repairs and replacements.

- In the event of a break-in resulting in theft of valuable equipment, commercial property insurance can provide compensation for the stolen items.

- If a severe storm causes flooding in your warehouse, leading to damage to stored inventory, commercial property insurance can assist in covering the losses.

Difference Between Named Perils and All-Risk Coverage

Commercial property insurance can be provided as either named perils or all-risk coverage:

Named perils coverage specifies the specific risks or perils that are covered by the policy, whereas all-risk coverage offers protection against all risks except those that are explicitly excluded in the policy.

Exclusions in Commercial Property Insurance

When it comes to commercial property insurance, it's crucial for policyholders to understand what is not covered under their policy. Exclusions are specific scenarios or types of damage that the insurance provider will not reimburse. Being aware of these exclusions is essential for proper risk management and ensuring adequate coverage.

Common Exclusions in Commercial Property Insurance

Here are some typical exclusions you might find in a commercial property insurance policy:

- Earthquake and flood damage

- Wear and tear or gradual deterioration

- Neglect or inadequate maintenance

- Acts of war or terrorism

- Nuclear hazards

Importance of Understanding Exclusions for Policyholders

Understanding exclusions in your commercial property insurance policy is crucial because it helps you identify potential gaps in coverage. By knowing what risks are not covered, policyholders can take proactive steps to mitigate those risks. This may involve purchasing additional coverage or implementing risk management strategies to reduce exposure.

Mitigating Risks Associated with Exclusions

Policyholders can mitigate risks associated with exclusions by:

- Reviewing their policy carefully to understand exclusions

- Consulting with their insurance agent to discuss additional coverage options

- Implementing risk management practices to minimize the likelihood of excluded events

- Maintaining detailed records and documentation to support claims

Factors Affecting Commercial Property Insurance Premiums

When it comes to commercial property insurance, the cost of premiums can vary based on several factors. Understanding what influences these premiums is crucial for businesses looking to protect their assets effectively and efficiently. Let's explore the key factors that affect commercial property insurance premiums.

Factors Influencing Premium Costs

- The location of the property: Properties located in areas prone to natural disasters or high crime rates may have higher premiums.

- The type of construction: The materials used in the construction of the property can impact premiums, with more fire-resistant materials often leading to lower costs.

- The value of the property and its contents: Higher property values and expensive equipment or inventory can lead to higher premiums.

- The level of coverage: The extent of coverage and specific add-ons included in the policy can affect premium costs.

- The deductible amount: Choosing a higher deductible can lower premiums but may require businesses to pay more out of pocket in the event of a claim.

Premium Determination for Small Businesses vs. Large Corporations

- Small businesses may have lower premiums compared to large corporations due to the size of their properties and the level of risk associated with their operations.

- Large corporations often have higher premiums because they typically have more assets to protect and may operate in multiple locations, increasing the overall risk exposure.

- However, large corporations may also have the advantage of negotiating better rates and customizing policies to meet their specific needs.

Strategies for Reducing Commercial Property Insurance Premiums

- Implementing safety and security measures: Installing alarm systems, sprinklers, and security cameras can reduce the risk of theft, vandalism, and other incidents, potentially lowering premiums.

- Bundling policies: Combining commercial property insurance with other types of business insurance can often lead to discounts and cost savings.

- Reviewing and updating coverage regularly: As business needs change and properties evolve, it's important to reassess coverage requirements to ensure adequate protection without overpaying for unnecessary add-ons.

- Working with an experienced insurance agent: A knowledgeable agent can help businesses navigate the complexities of commercial property insurance, find the best coverage options, and potentially secure better rates through their industry connections.

Importance of Business Interruption Coverage

Business interruption coverage is a crucial component of commercial property insurance that helps businesses recover from financial losses due to a temporary closure or interruption in operations.

Benefits of Business Interruption Coverage

- Provides coverage for lost income: Business interruption coverage helps compensate for the income that a business would have earned if it had been operating normally.

- Assists with ongoing expenses: This coverage can help cover fixed expenses such as rent, utilities, and salaries, even when the business is unable to operate.

- Supports temporary relocation: In case your business needs to operate from a temporary location after a covered incident, business interruption coverage can help cover the additional costs.

- Facilitates quick recovery: With financial support from business interruption coverage, businesses can recover faster and resume operations without facing significant financial strain.

Key Considerations When Choosing Commercial Property Insurance

When selecting a commercial property insurance policy, there are key factors that businesses need to consider to ensure they have adequate coverage tailored to their specific needs.

Customizing Coverage Based on Business Nature

- Understand the unique risks associated with your industry and location.

- Consider the value of your property, equipment, and inventory to determine appropriate coverage limits.

- Work with an insurance agent to customize your policy to address specific risks that your business may face.

Tips for Ensuring Adequate Coverage

- Regularly review and update your policy to reflect any changes in your business operations or property value.

- Consider adding endorsements or riders to cover additional risks not included in a standard policy.

- Document your property and assets to streamline the claims process in case of damage or loss.

- Compare quotes from multiple insurers to ensure you are getting the best coverage at a competitive price.

Final Thoughts

In conclusion, Commercial Property Insurance: What It Covers and Why sheds light on the crucial aspects of protecting business assets and operations. With a focus on understanding coverage, exclusions, and the importance of customization, businesses can make informed decisions to safeguard their interests.

FAQ Compilation

What is the importance of business interruption coverage in commercial property insurance?

Business interruption coverage helps businesses cover lost income and ongoing expenses when operations are disrupted due to a covered incident such as a fire or natural disaster.

How can policyholders mitigate risks associated with exclusions in commercial property insurance?

Policyholders can mitigate risks by understanding exclusions, seeking additional coverage if needed, and implementing risk management strategies to address potential gaps in protection.

What are named perils and all-risk coverage in commercial property insurance?

Named perils coverage specifies the risks included in the policy, while all-risk coverage provides broader protection by covering all risks except those explicitly excluded.