Exploring the realm of Short-Term Insurance Plans for Freelancers opens doors to a world of protection and flexibility. This guide aims to shed light on the nuances of short-term insurance, offering invaluable insights for freelancers seeking coverage tailored to their dynamic lifestyle.

Delve into the intricacies of short-term insurance plans and discover a wealth of information to help you navigate this essential aspect of freelance life.

Overview of Short-Term Insurance Plans for Freelancers

Short-term insurance plans for freelancers are temporary insurance policies that provide coverage for a limited period, typically ranging from a few weeks to a few months. These plans are designed to offer protection against unforeseen events or emergencies during specific projects or contracts.

Key Features of Short-Term Insurance Plans

- Flexibility: Short-term plans allow freelancers to customize coverage based on their current needs and projects.

- Quick Approval: Unlike traditional insurance plans, short-term options often have a faster approval process, providing immediate coverage.

- Affordability: Short-term insurance plans are usually more cost-effective than long-term options, making them suitable for freelancers with fluctuating income.

Benefits of Opting for Short-Term Insurance

- Project-Specific Coverage: Freelancers can tailor their insurance to match the requirements of different projects without committing to long-term contracts.

- Cost-Effective: Short-term plans offer affordable premiums, allowing freelancers to access essential coverage without breaking the bank.

- Quick Access to Coverage: With short approval times, freelancers can get immediate protection for their work and assets.

Limitations of Short-Term Insurance Plans

- Limited Coverage Period: Short-term plans only provide coverage for a specific duration, so freelancers may need to secure new policies frequently.

- Potential Gaps in Coverage: Depending on the plan, short-term insurance may have exclusions or limitations that could leave freelancers vulnerable in certain situations.

- No Long-Term Benefits: Short-term plans do not offer the same long-term benefits or stability as traditional insurance options, such as retirement savings or consistent coverage.

Types of Short-Term Insurance Plans Available

Short-term insurance plans tailored for freelancers offer a range of options to meet their specific needs and circumstances. These plans provide coverage for a limited period, offering flexibility and affordability.

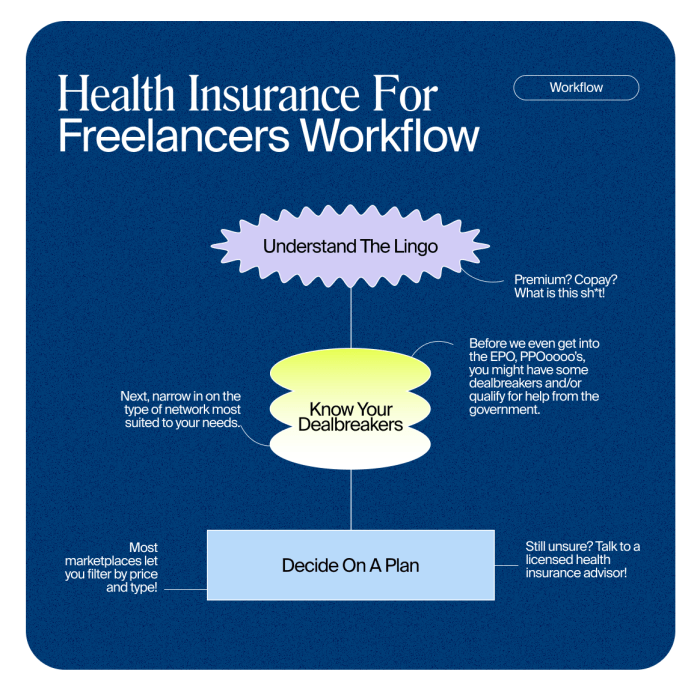

Short-Term Health Insurance Plans

Short-term health insurance plans are designed to provide temporary coverage for medical expenses. These plans typically offer benefits such as doctor visits, hospital stays, prescription drugs, and emergency care. However, they may have limitations on coverage for pre-existing conditions and preventive care.

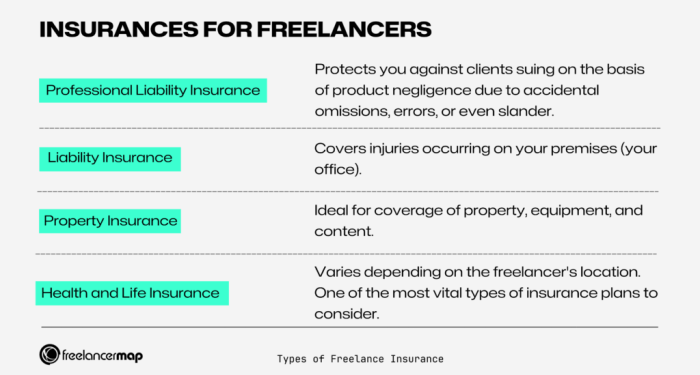

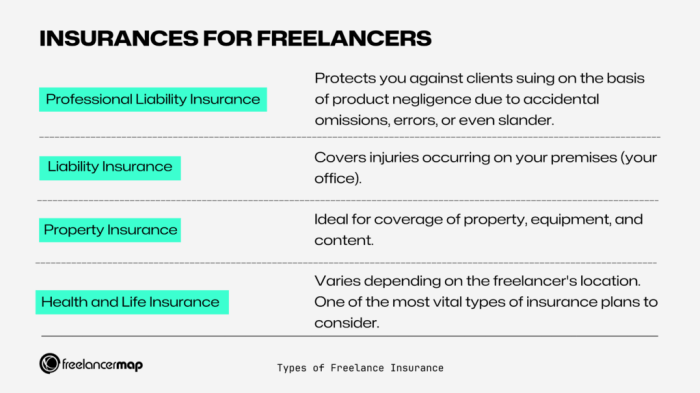

Other Types of Short-Term Insurance Plans

Aside from health insurance, freelancers can also opt for other types of short-term insurance plans such as:

- Short-Term Disability Insurance: Provides income replacement if a freelancer is unable to work due to a covered disability.

- Short-Term Liability Insurance: Offers protection in case a freelancer is sued for negligence or damages.

- Short-Term Property Insurance: Covers loss or damage to a freelancer's property or equipment.

Coverage Options in Short-Term Insurance Plans for Freelancers

Short-term insurance plans for freelancers typically offer coverage options that include:

- Flexible Coverage Periods: Freelancers can choose coverage for a specific period, such as a few months or up to a year.

- Customizable Benefits: Freelancers can tailor their coverage to include specific benefits that suit their needs, such as coverage for certain medical conditions or services.

- Affordable Premiums: Short-term insurance plans often have lower premiums compared to long-term plans, making them a cost-effective option for freelancers.

Considerations for Choosing Short-Term Insurance Plans

When selecting a short-term insurance plan as a freelancer, there are several important factors to consider to ensure you have the appropriate coverage for your needs.

Determining Coverage Amount Needed

- Assess your current financial situation and expenses to determine the amount of coverage needed.

- Consider any outstanding debts, monthly bills, and emergency funds required to maintain your lifestyle.

- Factor in any dependents or family members who rely on your income for support.

Reviewing Terms and Conditions

- Read through the policy thoroughly to understand what is covered and what is excluded.

- Pay attention to any limitations, restrictions, or exclusions that may impact your coverage.

- Ensure you are aware of any waiting periods, deductibles, or co-payments that apply to the policy.

Affordable Alternatives to Traditional Health Insurance

Freelancers often face the challenge of finding cost-effective health insurance options to meet their needs. Short-term insurance plans can be a viable alternative to traditional health insurance for freelancers looking to save money while still having coverage.

Cost-Effective Short-Term Insurance Options

Short-term insurance plans typically have lower monthly premiums compared to traditional health insurance plans. These plans provide coverage for a limited period, usually up to 364 days, making them a budget-friendly option for freelancers who may not need year-round coverage.

- Consider opting for a short-term insurance plan with a higher deductible to lower your monthly premium costs. This can help you save money on premiums while still having coverage for major medical expenses.

- Look for short-term plans that offer customizable coverage options, allowing you to select only the benefits you need. By tailoring your plan to your specific healthcare needs, you can avoid paying for coverage that you won't use.

- Compare quotes from different insurance providers to find the most affordable short-term insurance plan that meets your requirements. Shopping around can help you identify cost-effective options and potentially save money on premiums.

Pre-Existing Conditions and Short-Term Insurance

Freelancers with pre-existing conditions may find it challenging to secure affordable health insurance coverage. While short-term insurance plans may be more accessible than traditional plans, they often do not cover pre-existing conditions.

It's essential for freelancers with pre-existing conditions to carefully review the coverage exclusions of short-term insurance plans before purchasing. In some cases, it may be more cost-effective to explore other options, such as state-sponsored healthcare programs or healthcare sharing ministries.

Concluding Remarks

In conclusion, Short-Term Insurance Plans for Freelancers stand out as a versatile and practical option in the ever-changing landscape of insurance. By understanding the intricacies and benefits of these plans, freelancers can make informed decisions to safeguard their well-being and financial stability.

FAQ Overview

Are short-term insurance plans suitable for freelancers with pre-existing conditions?

Short-term insurance plans may not be the best option for freelancers with pre-existing conditions as these conditions are often excluded from coverage.

What factors should freelancers consider when choosing a short-term insurance plan?

Freelancers should consider factors such as coverage options, cost, network of providers, and duration of coverage when selecting a short-term insurance plan.

How can freelancers save money on short-term insurance plans?

Freelancers can save money on short-term insurance plans by opting for higher deductibles, comparing quotes from different providers, and taking advantage of any discounts or incentives available.